Date

29 Jan 2024Category

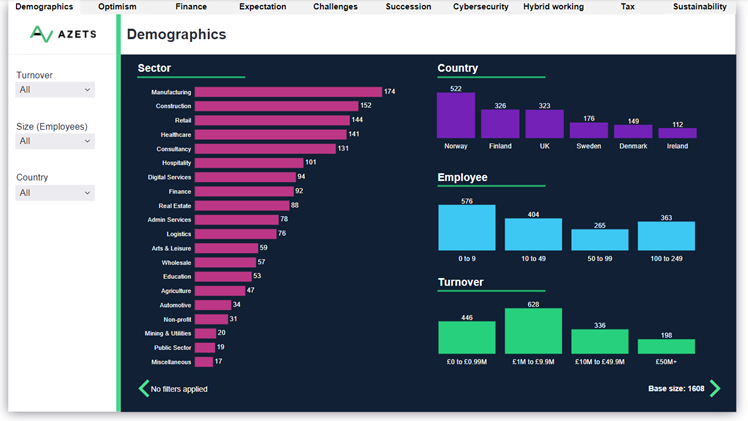

Azets has published the results of the Azets Barometer January 2024 survey, the first in a new series of triannual reports, surveying hundreds of business leaders to identify trends relating to economic outlook, financial performance, and emerging threats and opportunities.

The Azets Barometer provides insight into the current and future business climate through the perspective of ambitious mid-market, entrepreneurial, owner-managed, and family-owned businesses across the markets we serve in the UK, Ireland, Norway, Finland, Sweden, and Denmark.

Overall highlights:

View the full Azets Barometer January 2024 findings via our interactive dashboard.

The Azets Barometer reveals cautious optimism among businesses, with an average score of 5.6 out of 10. Upper mid-market businesses (100-249 employees) are the most optimistic at an average score of 6.7, with optimism increasing alongside business size.

The survey reveals a clear correlation between business size and financial confidence. Lower medium-sized businesses (50-99 employees) score 6.6, while upper medium businesses demonstrate strong financial sentiment at 7.0.

Economic and geopolitical uncertainty (both 5.7) are the challenges at the forefront of businesses’ minds, with the survey demonstrating no acute alarm over other challenges in the coming year, including talent recruitment and retention (4.9), regulatory compliance (4.5), operational issues (4.4), and technology adoption (4.3).

COVID-19, the number one concern across all regions in previous surveys carried out in 2021 and 2022, scored 3.3 overall, reflecting an adaptation to its impacts and a shift in focus towards emerging challenges.

One of the biggest impacts of COVID-19 was the shift to remote working, with larger businesses reporting more positive experiences. Micro and small businesses, scoring 5.4 and 5.5, see the shift as neutral or slightly positive. In contrast, lower medium (6.4) and upper medium-sized (6.8) businesses, and companies with higher turnovers (£10m to £49.9m at 6.2 and £50m to £99.9m at 7.3), find more significant benefits, likely due to better resources and infrastructure.

In terms of future planning, the report reveals that larger companies are more involved in succession planning. Businesses with a turnover of £0 to £0.99M have a low average score of 3.3, suggesting limited focus, which progressively increases, peaking at 7.0 for companies with turnovers between £50M and £99.9M.

This pattern implies smaller companies and those with lower turnovers might not prioritise or have resources for succession planning, highlighting an area for growth. Larger organisations, recognising its importance, integrate succession planning more effectively into their strategy, stressing the need for smaller businesses to plan for future leadership to ensure resilience and continuity.

Asked to rate the ability of their country's tax regime to promote or inhibit their company's performance, overall respondents feel that their country’s tax regime slightly inhibits their performance across business growth, employee recruitment/retention, innovation/R&D, and sustainability.

Both business growth and employee recruitment/retention scored 4.8, indicating concerns about tax impacts. Innovation/R&D and sustainability initiatives scored 4.9, reflecting similar perceptions. The overall sentiment is that the tax environment, while not highly detrimental, doesn't significantly promote growth or innovation.

Small businesses are more likely to feel penalised by their country's tax regime. The survey reveals that views on the impact of a country's tax regime vary notably across different business sizes and turnovers. Larger companies and those with higher turnovers generally see the tax system as more conducive to business, with scores up to 6.3, suggesting a supportive view. Conversely, micro and small businesses, scoring between 3.8 to 4.9, perceive the tax regime as moderately inhibitive, particularly in areas like growth and innovation.

This pattern extends to turnover analysis: businesses with lower turnovers score around 4.0, indicating a perceived negative impact, while those with turnovers over £50M score above 6.0, finding the tax environment more favourable, especially for sustainability and innovation

These results imply that while larger businesses with ample resources navigate tax policies more efficiently, smaller businesses might find these policies more challenging, impacting their growth and strategies.

Small businesses are also struggling to implement even basic sustainability initiatives. Micro businesses and those with lower turnovers primarily focus on basic sustainability initiatives, with 38% in both categories adopting these practices. However, their engagement in advanced sustainability actions is low (6% for micro businesses and 4% for the lowest turnover category), and a significant number don't pursue any sustainability initiatives (35% and 42% respectively).

In contrast, larger businesses, like upper medium-sized and high turnover companies (£100M+), are more involved in advanced sustainability efforts (21% and 27% respectively), with fewer not engaging at all (2% and 10%). This trend indicates that larger or higher turnover businesses are more likely or able to invest in comprehensive sustainability practices, suggesting a resource disparity where smaller businesses may lack the capacity or awareness for extensive sustainability measures.

Chris Horne, Group Chief Executive Officer at Azets, said: “I am delighted to present the findings of our Azets Barometer January 2024 survey. As a leading Northern European advisory, compliance, and outsourcing group, with a laser focus on supporting ambitious businesses and their owners, the Azets Barometer helps us to bang the drum on behalf of entrepreneurial, owner-managed, and family-owned companies that are underserved by the traditional large accounting firms.

“The Azets Barometer reflects the views of more than 1,600 business leaders, revealing an average economic outlook score of 5.6 and indicating cautious optimism and a blend of hope with realism about ongoing challenges for the year ahead. The survey results highlight that businesses have gaps in their succession planning, cyber security awareness, and sustainability initiatives, while it’s clear that tax regimes are generally considered inhibitive to growth and innovation across all markets.

“Challenges are much more pronounced in smaller and mid-sized businesses, which are the lifeblood of the European economy. This demonstrates that now more than ever, growing businesses require specialist advice against a backdrop of complex economic and geopolitical uncertainties. We pride ourselves on our ability to understand and meet the needs of these ambitious businesses through the delivery of personalised client service, underpinned by technology, delivered by our expert team of talented smart colleagues in each of our markets.”

To see the full Azets Barometer findings, please click here for our interactive dashboard.